Effective Debt Debt Consolidation Strategies for Financial Flexibility: More Discussion Posted Here

Effective Debt Debt Consolidation Strategies for Financial Flexibility: More Discussion Posted Here

Blog Article

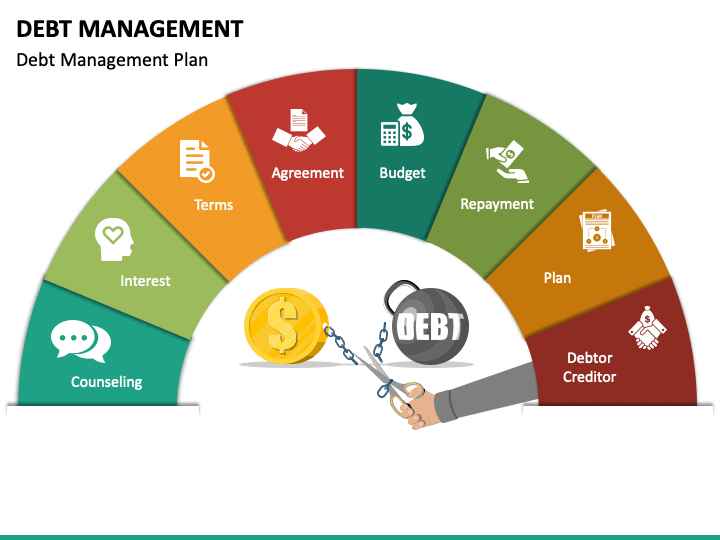

Understanding the Trick Conveniences of Implementing a Debt Management Prepare For Financial Security and Safety

Enhanced Financial Organization

A budget serves as a roadmap for monetary decision-making, allowing individuals to track their spending, determine locations for possible cost savings, and allot funds towards vital expenses, cost savings, and financial obligation settlements. Budgeting enables individuals to set reasonable monetary objectives, whether it be developing an emergency fund, conserving for a significant acquisition, or paying off financial obligation.

Along with budgeting, arranging monetary files and declarations is crucial for keeping financial order. By maintaining track of expenses, account statements, and important financial information in an orderly manner, individuals can quickly monitor their economic progress, determine discrepancies, and make informed decisions. Executing systems such as digital economic devices or filing systems can simplify the company process and make certain that economic info is conveniently available when required. Eventually, boosted monetary company through budgeting and record administration lays a solid structure for financial security and success.

Decreased Rate Of Interest

By tactically negotiating with creditors and checking out refinancing options, people can work towards safeguarding reduced rate of interest prices to speed up and alleviate economic burdens financial debt repayment. Lowered passion rates play a crucial duty in making debt a lot more workable and cost-effective for individuals seeking financial stability.

By consolidating financial debts or working out reduced prices with lenders, individuals can decrease their general cost of borrowing, ultimately enhancing their monetary health and wellness. On the whole, safeguarding lowered passion prices via a financial debt monitoring plan can supply people with a much more lasting path in the direction of economic safety and security and financial debt liberty.

Consolidated Financial Obligation Payments

Consolidated financial debt payments streamline financial commitments by integrating multiple financial debts right into a single convenient repayment, simplifying the settlement process and possibly lowering general rate of interest expenses. This technique can provide individuals with a more clear review of their economic commitments, making it easier to spending plan and prepare for settlements. By combining debts, individuals can frequently take advantage of lower rate of interest prices, specifically if the new combined finance has a reduced average rate of my company interest contrasted to the specific financial debts. This can cause significant lasting savings by decreasing the total amount paid in passion over the life of the car loan.

Moreover, consolidated financial debt settlements can aid enhance credit history by ensuring consistent and timely payments. Struggling or missing out on settlements to maintain track of multiple due days can adversely influence credit rating. With a solitary, combined repayment, individuals are much less most likely to miss out on settlements, thereby enhancing their creditworthiness gradually. On the whole, combined financial obligation payments provide a efficient and useful method for people to manage their financial debts, reduce monetary stress, and job in the direction of attaining higher monetary stability and safety.

Expert Financial Guidance

Navigating the intricacies of financial monitoring often requires looking for professional guidance to ensure educated decision-making and tactical planning for lasting stability and success. Expert go to website financial advice can provide people with the expertise and support needed to navigate difficult economic situations successfully. Financial experts or counselors can offer tailored suggestions based on a person's specific situations, helping them recognize the effects of their economic decisions and charting a path towards monetary protection.

One key benefit of specialist economic support is the accessibility to customized financial strategies. More Discussion Posted Here. These experts can evaluate a person's monetary circumstance, develop an extensive strategy to deal with debt management problems, and give recurring assistance and tracking. Additionally, monetary specialists can supply understandings on budgeting, saving, and investing, equipping individuals to make audio economic selections

Improved Credit Rating

Looking for professional monetary assistance can play an essential role in boosting one's credit rating and overall economic health and wellness. When executing a debt monitoring plan, individuals can experience a favorable effect on their credit report. By working with economists, individuals can discover effective techniques to manage their financial obligations sensibly, make prompt settlements, and bargain with creditors to potentially lower rates of interest or forgo costs. These actions not just aid in hop over to here minimizing financial debt however additionally in establishing an extra favorable credit scores background.

A financial obligation management plan can additionally help in settling multiple debts right into one manageable monthly payment, which can protect against missed settlements that negatively impact credit rating - More Discussion Posted Here. Additionally, by sticking to the structured repayment plan outlined in the debt management program, individuals can show economic obligation to credit scores reporting agencies, resulting in gradual improvements in their credit rating gradually

Final Thought

Finally, executing a financial obligation administration plan can supply improved monetary organization, decreased rate of interest rates, consolidated financial obligation repayments, expert financial advice, and improved credit history. By complying with an organized strategy, people can better manage their financial obligations and work towards monetary stability and security. It is essential to think about the advantages of a debt management plan in order to improve one's total economic health.

In general, consolidated debt settlements offer a efficient and useful means for individuals to manage their financial debts, decrease monetary stress, and work in the direction of attaining greater monetary security and protection.

Specialist monetary advice can provide people with the experience and support required to browse difficult monetary situations successfully. Financial consultants or therapists can supply customized suggestions based on a person's specific situations, assisting them comprehend the effects of their financial choices and charting a course towards monetary safety and security.

Furthermore, economic specialists can provide insights on budgeting, conserving, and investing, empowering individuals to make sound monetary selections.

In conclusion, applying a financial debt monitoring plan can give improved financial company, lowered passion prices, consolidated financial obligation settlements, specialist financial advice, and enhanced credit score.

Report this page